For entrepreneurs in the Rio Grande Valley (RGV), separating personal and business finances is more than a smart move—it’s a critical step for sustainable growth. A business checking account helps keep financial records clean, simplifies tax season, and protects your assets.

The right business checking account does more than store your money. It becomes a powerful tool to monitor cash flow, track expenses, and build your business credit profile. In the dynamic RGV business environment, having banking features tailored to your specific needs can streamline operations, offer real-time insight into your cash flow, and even help build your business credit.

In this guide, we’ll walk you through the key features, fee structures, and account options that every RGV entrepreneur should know about, especially those offered by Bank of South Texas.

Key Features to Look For in a Business Checking Account

A good business checking account goes beyond basic deposit and withdrawal capabilities. It provides tools that support your business growth and simplify daily operations.

Top Features for RGV Entrepreneurs:

- Digital Banking Tools

- Free e-statements

- Online banking and bill pay

- Mobile app access

- Instant Issue Debit Cards

- Get your card the same day you open your account—no waiting

- Get your card the same day you open your account—no waiting

- Extensive ATM Access

- Over 55,000 surcharge-free ATMs

- Over 55,000 surcharge-free ATMs

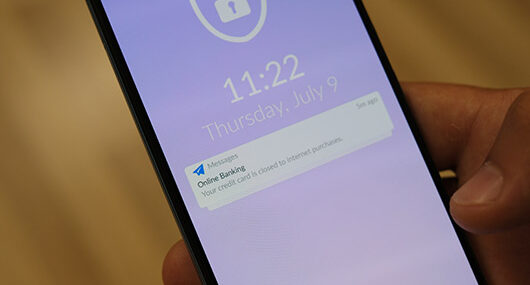

- Security and Control with CardValet

- Real-time alerts

- Ability to turn your card on/off via mobile app

- Overdraft Protection Options

- Helps prevent declined payments

- Maintains vendor relationships

Having access to these features ensures your business stays agile and secure. Time saved with digital tools and fewer unexpected fees can directly impact your bottom line, allowing you to focus on running and growing your business.

Understanding Fee Structures and How to Maximize Value

Choosing the appropriate account involves understanding the associated fees and limits. These often include:

| Fee Type | Description |

| Monthly Service Charges | Regular fees for account maintenance |

| Transaction Limits | Charges after a set number of free transactions |

| Minimum Balance Requirements | Fee waivers based on your account balance |

Bank of South Texas Business Account Options

Bank of South Texas offers several options tailored to different business needs.

| Account Type | Free Transactions | Balance to Waive Fee | Monthly Fee |

| Value Business Checking | 400 | $5,000 | $0 |

| Choice Business Checking | 200 | $2,500 | $0 |

| Non-Profit Org Checking | 50 | $700 | $4 |

Tips to Maximize Value

- Keep balances above the minimum requirements to avoid monthly fees

- Track your monthly transactions to stay within your free limit

- Choose an account that matches your transaction volume

Carefully analyzing fee structures can save your business hundreds of dollars annually. Entrepreneurs often overlook these details, but even small fees can accumulate quickly.

A well-matched account ensures you pay only for what you need while maximizing benefits.

Choosing the Right Account: Match Features to Your Business Needs

Every business is different. Choosing a checking account should reflect your transaction volume, cash flow, and long-term goals.

Account Comparison by Business Size:

| Business Type | Best Account Option | Why? |

| High-transaction business | Value Business Checking | 400 free transactions, ideal for high volume |

| Small business/startup | Choice Business Checking | Lower minimum balance with solid benefits |

| Nonprofit | Non-Profit Org Checking | Lower monthly fee and balance requirement |

Personalized Service Makes a Difference

Bank of South Texas emphasizes personal relationships. What separates us from other banks is the way we serve our clients.

Local banks like Bank of South Texas understand the regional economy and can:

- Offer tailored banking solutions

- Provide fast decisions and responses

- Adapt to your growing needs

By engaging with a community-focused bank, you benefit from advisors who know the local business climate and can provide personalized insights—not just cookie-cutter solutions.

RGV Business Banking: The Big Picture

Here’s a pie chart showing the most valued features by RGV business owners based on recent feedback:

Understanding what other local entrepreneurs value most can guide your decision-making. With a potent combination of convenience, control, and cost-efficiency, modern business checking accounts are more than just a place to keep your funds—they’re strategic financial tools.

Take the Step: Grow Your Business

Whether you’re just getting started or scaling up, Bank of South Texas has a checking solution tailored to your business needs. From generous transaction allowances to robust security features and unmatched local support, it’s a partnership that supports your success.

🔹 Explore your options

🔹 Stay on top of your finances

🔹 Bank with professionals who understand the Valley

Take control of your business finances today. Discover how Bank of South Texas can help you thrive.