Checking Services

The perfect checking account is the one that works best for you. We offer a wide range of checking account solutions to meet your needs.

Compare Checking Services

What do you want in a checking account? We can help you find the right solution.

Star Checking |

|---|

| Free Bill Pay |

| Free Debit Card |

| Free E-statements |

| Free Online & Mobile Banking |

| Unlimited Transactions |

| Access to 55,000 Free ATMs |

| Minimum balance to open an account - $50.00 |

| Monthly Service Charge - $5.00 |

Regular Checking |

|---|

| Free Bill Pay |

| Free Debit Card |

| Free E-statements |

| Free Online & Mobile Banking |

| Unlimited Transactions |

| Access to 55,000 Free ATMs |

| Minimum balance to open an account - $50.00 |

| Monthly Service Charge - $10.00 |

| No service charge if minimum balance is $700.00 and above |

| $4.00 service charge if minimum balance is $500.00 – $699.99 |

| $6.00 service charge if minimum balance is $200.00- $499.99 |

| $8.00 service charge if minimum balance is $0.00 – $199.99 |

Gold Star Checking |

|---|

| Free Bill Pay |

| Free Debit Card |

| Free E-statements |

| Free Online & Mobile Banking |

| Unlimited Transactions |

| Access to 55,000 Free ATMs |

| Minimum balance to open an account - $50.00 |

| No monthly service charge |

| You must be at least 55 years of age and have direct deposit to qualify for this account. |

NOW Account |

|---|

| Free Bill Pay |

| Free Debit Card |

| Free E-statements |

| Free Online & Mobile Banking |

| Unlimited Transactions |

| Access to 55,000 Free ATMs |

| Monthly Service Charge - $10.00 |

Features

All of our products and services come with the latest features and benefits.

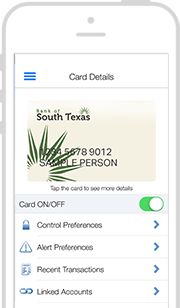

Mobile Banking

Our free Mobile Banking service makes it easy to track your spending, pay bills, send money, deposit checks, and more.

Learn More

Online Banking

Our user-friendly interface allows you to see bill payment activity, view balances, monitor transactions, and more.

Learn More

Instant Debit Card

No more waiting! Walk in to any branch to open an account and walk out with your new debit card in hand - instantly!

Learn More

ATM Services

Bank of South Texas customers can access thousands of surcharge-free ATMs worldwide thanks to our partnership with Allpoint.

Learn More

Overdraft Program

We offer a variety of overdraft protection options that can help protect you and give you financial peace of mind.

Learn More