Taking out a business loan can feel like a lifeline—whether you’re launching a startup, expanding your operations, or covering unexpected expenses. The promise of quick capital can be enticing, but the true cost of a business loan goes beyond the advertised interest rate. Hidden fees, additional charges, and unexpected terms can significantly impact how much you’ll actually pay.

Understanding the full spectrum of business loan fees ensures that you make informed financial decisions. In this article, we’ll uncover the real cost of business loans, including often-overlooked fees, tax-deductibility of loan charges, and strategies to minimize expenses.

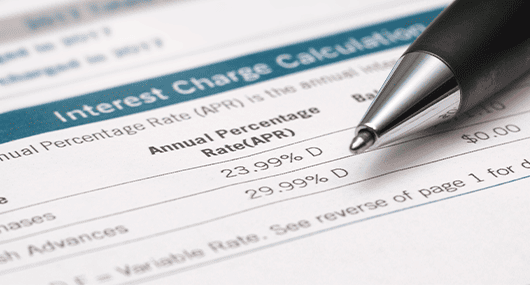

The Interest Rate Illusion: Why APR Matters More

When shopping for a business loan, the interest rate is often the first thing you look at. But is it the most important number? Not necessarily. Many lenders advertise attractively low rates but bury additional business loan costs in fees and fine print.

Instead of focusing solely on the interest rate, pay close attention to the Annual Percentage Rate (APR). APR includes both the interest rate and additional fees and provides you with a more accurate picture of what you’ll actually be paying over time. Even a small difference in APR can lead to thousands of dollars in additional costs over the life of your loan.

For example, a loan with a 5% interest rate but 2% in additional fees can be more expensive than a 6% interest rate loan with no extra fees. This is why understanding the APR is crucial. Always compare APRs rather than just interest rates to ensure you’re getting the best deal.

Unpacking the Business Loan Fees: What You’re Really Paying For

Interest is just one piece of the puzzle. Business loans often come with a variety of fees, some of which are subtly incorporated into the loan structure, making them harder to detect at first glance.

1. Origination Fees

These fees are charged by lenders to cover the administrative costs of processing your loan.

- Typically, 1-6% of the loan amount.

- Charged for processing the loan application.

- Can be added to the loan balance, meaning you pay interest on it.

- Some lenders may label this as a “processing fee” or “funding fee.”

Example: If you take a $100,000 loan with a 3% origination fee, you pay $3,000 upfront or have it added to the loan balance, increasing your repayment amount.

2. Application Fees

A non-refundable fee that covers the cost of reviewing and processing your loan application.

- Can range from $50 to $500, depending on the lender.

- Even if your loan isn’t approved, you won’t get this money back.

- Some lenders may waive this fee for highly qualified applicants, so it’s worth negotiating before applying.

3. Closing Costs

Closing fees are associated with finalizing the loan and can include legal fees, business valuations, real estate appraisals, and administrative costs. These costs can vary significantly, sometimes reaching thousands of dollars.

Example: If you’re securing a loan against property, you may have to pay for a commercial appraisal, which could cost anywhere from $500 to $5,000.

4. Underwriting Fees

This fee covers the lender’s process of verifying your financial documents and assessing your creditworthiness and risk level.

- Typically, 1-3% of the loan amount.

- Lenders use this to evaluate your creditworthiness and risk.

- Some lenders may bundle this into origination fees, so ask for a breakdown.

5. Service or Maintenance Fees

Some lenders charge monthly or annual service fees to cover the cost of managing your loan.

- Fees can range from $10 to $50 per month, which adds up over the duration of your loan.

- Can be avoided by choosing lenders with no ongoing fees.

6. Prepayment Penalties

Some loans impose penalties if you pay off the loan earlier than scheduled.

- Lenders impose these fees to compensate for the interest income they lose when a borrower repays early.

- If you anticipate paying your loan off early, look for lenders that don’t charge prepayment penalties.

Example: A 2% prepayment penalty on a $50,000 remaining balance would cost you $1,000.

7. Late Payment Fees

If you miss a payment deadline, lenders may charge a penalty, either as a flat rate or a percentage of the overdue amount.

- These fees can accumulate quickly, negatively affecting both your cash flow and your credit rating.

- Some lenders provide a grace period before applying late fees, so it’s important to check loan terms in advance.

Example: A lender may charge $50 or 5% of the missed payment amount, whichever is greater.

By understanding these fees and negotiating where possible, you can reduce the overall cost of borrowing and avoid unexpected financial burdens.

Are Business Loan Fees Tax-Deductible?

A common question among business owners is whether loan fees, including origination fees, are deductible. Here’s the breakdown:

- Origination fees: Often deductible as a business expense, but only if the loan is used for business purposes.

- Interest payments: Generally tax-deductible, but only on the portion of the loan used for business expenses.

- Application and service fees: Deductible if directly related to business operations.

- Prepayment penalties: May be deductible, but it depends on the lender’s classification of the fee.

How to Minimize the Cost of Your Business Loan

Now that you know where the hidden costs lie, here are some strategies to minimize expenses and ensure you’re getting the best deal:

1. Shop Around and Compare APRs

Not all lenders offer the same terms, so it’s crucial to compare multiple loan offers before making a decision. Some lenders may provide lower interest rates but compensate by adding additional fees, which increases the overall cost. When evaluating loan offers, look beyond the interest rate and focus on the Annual Percentage Rate (APR), as this includes both the interest rate and any extra charges associated with the loan.

Tips:

- Get quotes from at least three lenders to compare rates and fees.

- Check both traditional banks and online lenders since they may have different fee structures.

- Use online loan comparison tools to analyze multiple offers efficiently.

2. Negotiate Fees

Many borrowers don’t realize that loan fees can often be negotiated. Lenders want your business and may be willing to lower or waive some fees, particularly if you have a strong credit history or existing banking relationship with them.

How to negotiate:

- Ask upfront if origination, underwriting, or application fees can be waived.

- Leverage multiple offers by telling lenders about better terms you’ve received elsewhere.

- Request a breakdown of all fees so you can challenge any unnecessary or excessive charges.

3. Improve Your Credit Score

Your credit score decides the interest rate and fees you’ll be charged. A higher score tells lenders that you are a low-risk borrower and can help you get better loan terms.

Ways to improve your credit score:

- Pay bills on time: Late payments negatively impact your credit score.

- Reduce outstanding debt: Lower credit utilization improves your score.

- Avoid opening too many new accounts: Each credit inquiry slightly lowers your score.

- Check your credit report for errors: Dispute inaccuracies that might be dragging your score down.

4. Consider Alternative Financing Options

Traditional commercial loans are not the only financing option available. Depending on your needs, alternative funding sources may offer lower costs or more flexibility.

Alternatives to consider:

- Business lines of credit: Flexible borrowing that allows you to take only what you need, reducing unnecessary interest payments.

- SBA loans: Government-backed loans that often have lower fees and better terms.

- Crowdfunding: Raising small amounts from many investors can be an interest-free way to fund your business.

- Revenue-based financing: Repayments are based on a percentage of your revenue, making it more manageable during slow months.

Contact Bank of South Texas to learn about our business financing options.

5. Read the Fine Print

Loan agreements can be complex, with hidden fees and restrictive terms buried in legal jargon. Before signing any contract, carefully review all terms and conditions.

What to look for:

- Prepayment penalties: Some lenders charge fees if you pay off the loan early.

- Variable vs. fixed rates: Variable rates may increase over time, leading to higher costs.

- Balloon payments: Some loans have a large final payment that can be financially burdensome.

- Restrictions on additional borrowing: Some agreements prohibit taking on additional loans without lender approval.

Knowledge is Power

Taking out a business loan isn’t just about getting approved—it’s about understanding what you’re committing to. The more informed you are about hidden fees, tax deductions, and ways to reduce business loan costs, the better positioned you’ll be to make smart financial decisions.

- Before signing on the dotted line, ask yourself:

- What is the total cost of this loan, including all fees?

- Is there a more cost-effective financing option available?

- Can I negotiate better terms?

By being proactive and educated, you can secure the funding your business needs without falling into unnecessary financial traps. A loan should be a stepping stone to growth, not an anchor dragging you down with hidden costs.

Secure a Transparent Business Loan with Bank of South Texas

Ready to secure a business loan with transparent terms and competitive rates? Partner with Bank of South Texas, where personalized service meets financial expertise. Our loan advisors are here to help you navigate fees, understand your costs, and structure the best loan for your business.

Visit a Bank of South Texas branch or contact us at (956) 687-4260 for a consultation and unlock smarter financing solutions for your business needs.