The year-end bonus season is upon us—a moment many eagerly await! Whether you see it as a reward for your hard work or an opportunity to treat yourself, it’s important to learn financial windfall management.

While it’s tempting to splurge on something fun (and you should, to some extent), there are smart ways to use your bonus that can improve your financial well-being for years to come.

Let’s learn ten strategies that strike the perfect balance between indulgence and responsibility.

1. Build or Boost Your Emergency Fund

An emergency fund is your first line of defense against life’s curveballs. If you don’t already have one, now’s the time to start. If you do, use this opportunity to bulk it up. Financial experts recommend saving enough to cover the living expenses for three to six months.

Why does this matter? In an unforeseen event, like an unexpected medical bill, car repair, or even a job loss, a well-funded emergency account will prevent you from relying on high-interest credit cards or loans.

It is highly recommended to place these savings in a high-yield savings account so they grow while staying easily accessible.

Pro Tip: Start with a goal of saving $1,000 if you’re just getting started, and then work toward the full three-to-six-month cushion over time.

2. Invest in Certificates of Deposit (CDs)

Certificates of Deposit (CDs) are a low-risk way to grow your money with guaranteed returns, especially in a high-interest-rate environment. CDs offer fixed interest rates for a set term, making them a reliable choice for savers who don’t need immediate access to their money.

Consider using your bonus to set up a CD ladder, a strategy where you divide your investment into multiple CDs with staggered maturity dates. For instance, you could invest in one-year, two-year, and three-year CDs simultaneously. When the one-year CD matures, reinvest it into a new three-year CD to maximize your returns while keeping some funds accessible periodically.

Pro Tip: Let’s say you receive a $5,000 bonus. You could allocate $1,500 to a one-year CD, $1,500 to a two-year CD, and $2,000 to a three-year CD. This strategy ensures liquidity while optimizing interest earnings.

3. Pay Off High-Interest Debt

Few things eat into your finances faster than high-interest debt. Whether it’s credit cards, personal loans, or payday advances, these obligations can hold you back from achieving your financial goals.

Use your bonus to pay down (or pay off) these balances, starting with the debt that carries the highest interest rate. Reducing this burden not only saves you money in the long run but also improves your credit score. A good credit score can, in return, lead to better financial opportunities in the future.

Pro Tip: If you owe $2,000 on a credit card with a 20% interest rate, paying it off saves you $400 in annual interest costs. That’s a powerful use of your bonus!

4. Boost Your Retirement Savings

It’s never too early—or too late—to invest in your future self. Use your bonus to contribute to your retirement accounts, like a 401(k) or IRA. If your employer offers a matching program, make sure you’re maximizing that benefit—it’s essentially free money!

Even a small bonus allocation can grow significantly over time, thanks to compound interest. For example, a $2,000 investment today could grow to over $10,000 in 20 years, assuming a 7% average annual return.

Pro Tip: If you’re already maxing out your tax-advantaged accounts, consider opening a taxable brokerage account and investing in diversified index funds.

5. Plan for Big-Ticket Goals

Have you been dreaming about remodeling your kitchen, traveling abroad, or starting a business? Your bonus can make those big-ticket dreams more achievable.

Instead of financing these expenses with loans or credit, earmark your bonus for these goals. Open a dedicated savings account for this purpose and contribute regularly. By planning ahead, you can avoid the stress of unplanned expenses while enjoying the process of working toward something exciting.

Pro Tip: If you plan to renovate your home in two years, investing your bonus in a short-term CD could allow your money to grow while ensuring it’s available when needed.

6. Invest in Yourself

The best investment is often the one you make in yourself. Consider using part of your bonus to upgrade your skills or knowledge. This could mean enrolling in an online course, attending a professional conference, or purchasing books and tools to enhance your career or personal development.

For example, if you’re eyeing a promotion or a career shift, learning a new skill—like coding, project management, or a foreign language—could increase your earning potential and open up new opportunities.

Pro Tip: Not everything has to be work-related. Taking a class in photography, cooking, or mindfulness can boost your personal fulfillment, too.

7. Give Back to Causes You Care About

Generosity feels good and does good. Sharing your bonus with others—whether through charitable donations, gifts to loved ones, or community contributions—can have a meaningful impact.

Charitable donations may also come with tax benefits, depending on your jurisdiction and the organization you support. Check with a tax advisor to understand how you can maximize your giving while reaping potential deductions.

Pro Tip: If you’re passionate about education, sponsor a scholarship for underprivileged students or donate to an organization supporting literacy programs.

8. Optimize Your Savings Strategy

Most people stick to regular savings accounts, but better options might be available. Go for money market accounts or high-yield savings accounts that offer competitive interest rates. These accounts often have no risk and can make your money work harder for you.

Pro Tip: McAllen residents, for instance, might find local banks and credit unions offering better-than-average CD rates. Research is important! Talk with the bankers at Bank of South Texas to learn more.

9. Treat Yourself—But Set Limits

While being financially responsible is important, it’s okay to indulge a little. Set aside a small portion of your bonus—say, 10–20%—for guilt-free spending.

Whether it’s a luxurious spa day, a fancy gadget, or a weekend getaway, a well-planned splurge can keep you motivated while maintaining financial balance.

Pro Tip: Decide on your splurge budget before shopping to avoid overspending. This way, you can enjoy the treat without buyer’s remorse.

10. Plan for Irregular Expenses

Not all expenses are emergencies—some are predictable but infrequent, like insurance premiums, holiday gifts, and annual subscriptions. Setting aside part of your bonus to cover these costs can help smooth out your cash flow and prevent budget surprises throughout the year.

By planning ahead, you can avoid the temptation to dip into your emergency fund or rely on credit for these recurring but irregular expenses. This creates a more stress-free financial rhythm.

Pro Tip: Use a budgeting tool to track these annual costs and set up automated transfers into a designated “irregular expenses” account each month. This ensures you’re always prepared when the bills roll in.

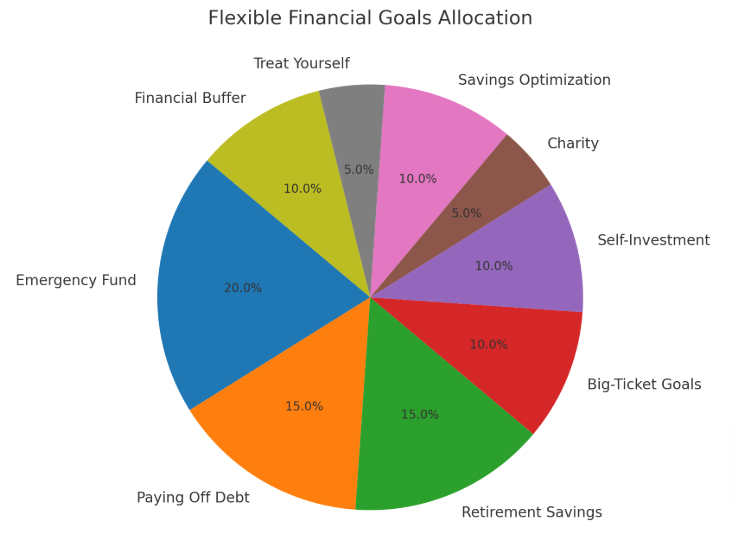

Bonus: Example Allocation of Year-End Bonus

Here is an example allocation that provides a flexible framework to help you prioritize essential financial goals like saving for emergencies, reducing debt, and planning for the future while leaving room for personal growth, generosity, and a bit of fun.

Use this as a guide to ensure your bonus works as hard as you do!

Must: Use a Financial Calculator to Make Smarter Decisions

A financial calculator can be a powerful tool to help you optimize the use of your year-end bonus. A financial calculator can simplify the process if you’re looking to assess the impact of paying off debt early, explore the benefits of saving in a high-interest account, or calculate investment growth over time.

For example, you can use a financial calculator to:

-

Calculate Loan Repayments: If you’re using part of your bonus to pay off debt, a financial calculator can show you how much you’ll save in interest over time by making extra payments. It can also help you determine the impact of different repayment strategies on your overall financial plan.

-

Project Investment Growth: If you’re allocating your bonus to investments, a financial calculator can help you project the potential growth of your money over time. By inputting your bonus amount, expected interest rate, and time horizon, you can see how much your investment might grow, allowing you to make better decisions about where to place your funds.

-

Evaluate Savings Goals: If you’re using your bonus to fund a specific savings goal, such as a down payment on a house or a future vacation, a financial calculator can help you determine how much to save each month or year to reach that target, factoring in interest growth.

Pro Tip: Many online financial calculators are available for free, or you can use the built-in calculators in apps provided by banks or investment platforms. Take advantage of these tools to visualize your financial future and make data-driven decisions.

Turn Your Bonus Into an Opportunity With Bank of South Texas

A year-end bonus requires financial windfall management—it’s a chance to reshape your financial future. Whether you choose to grow your savings, pay off debt, or invest in your goals, a thoughtful approach ensures you make the most of this opportunity.

Bank of South Texas recommends you approach practicality with a bit of fun to enjoy the rewards of your hard work today while building a stronger financial foundation for tomorrow. So go ahead, plan wisely, and make this bonus count!

To open an account, invest in CDs, or for any other banking-related assistance, contact us today.